— Media

Globe St.: Old Mission Expands Lease at 120 Broadway

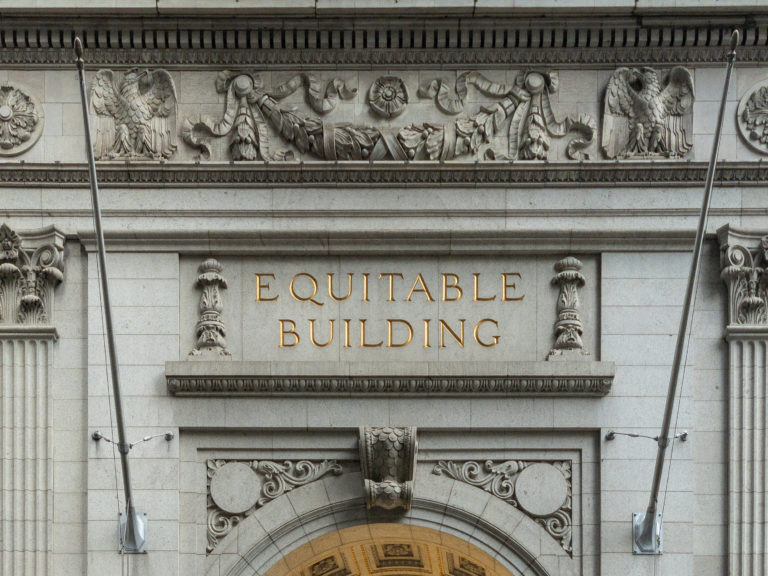

Starting in April 2021, the multi-asset market-making firm will occupy nearly four times its previous footprint within the building. The global, multi-asset market-making firm, Old Mission has renewed and expanded its lease in downtown Manhattan at 120 Broadway.